How to Build a Steady Freelance Income: The 2025 Financial Stability Blueprint

I still remember the panic of my second year freelancing. I had just finished a massive project, the invoice was paid, and I felt rich. Two weeks later, my calendar was empty, my inbox was silent, and that “rich” feeling evaporated into pure anxiety. If you’ve ever stared at your bank account wondering if you’ll make rent next month, you know exactly what I’m talking about.

In 2025, the “feast or famine” cycle is no longer a rite of passage—it’s a business failure. With the gig economy maturing, relying on luck or waiting for the phone to ring is a strategy for bankruptcy.

The landscape has shifted. According to MBO Partners’ October 2024 report, the number of full-time independent workers in the U.S. has surged to 27.7 million, a 6.5% increase from the previous year. This isn’t just a side hustle anymore; it’s a primary career choice for millions. But the difference between those who burn out and those who build wealth lies in one thing: Financial Infrastructure.

In this guide, I’m going to walk you through the “Income Smoothing” method and the 3-tier client structure used by top-earning solopreneurs to turn jagged cash flow into a predictable salary.

The Shifting Landscape: Freelancing as a Business in 2025

You might be wondering, “Is the market actually stable enough for this?” The answer is a resounding yes, but only if you treat yourself as a micro-agency rather than a temporary worker.

The sheer economic impact of our industry is staggering. U.S. freelancers contributed $1.5 trillion to the economy in 2024, according to Upwork’s Freelance Forward research. This indicates that companies aren’t just using freelancers for overflow work; they are integrating us into their core operations.

The AI Evolution: From “Task-Taker” to “Strategic Consultant”

There is an elephant in the room: Artificial Intelligence. I hear from freelancers every day who are terrified that AI will eat their income. The reality? It’s only eating the low-hanging fruit.

High earners are leaning in. In fact, MBO Partners’ 15th Annual Report (2025) reveals that 74% of independent workers are now using generative AI to increase their competitiveness. The freelancers building steady income today aren’t selling 500 words of generic copy; they are selling strategy, personality, and complex problem-solving—things AI still struggles to replicate.

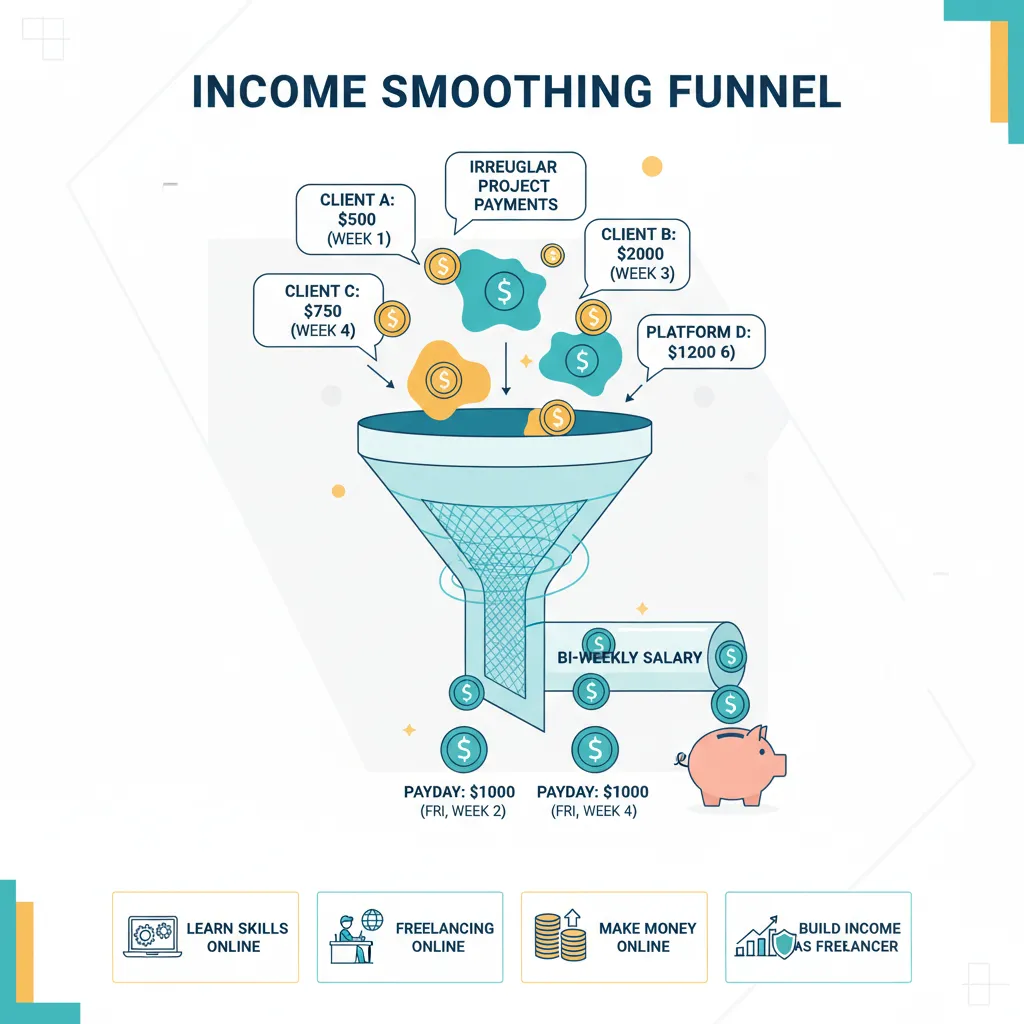

The “Income Smoothing” Method: Paying Yourself a Fixed Salary

The biggest mistake I see intelligent freelancers make is treating their business revenue as their personal income. They get paid $5,000 and immediately spend $5,000. This is a recipe for disaster.

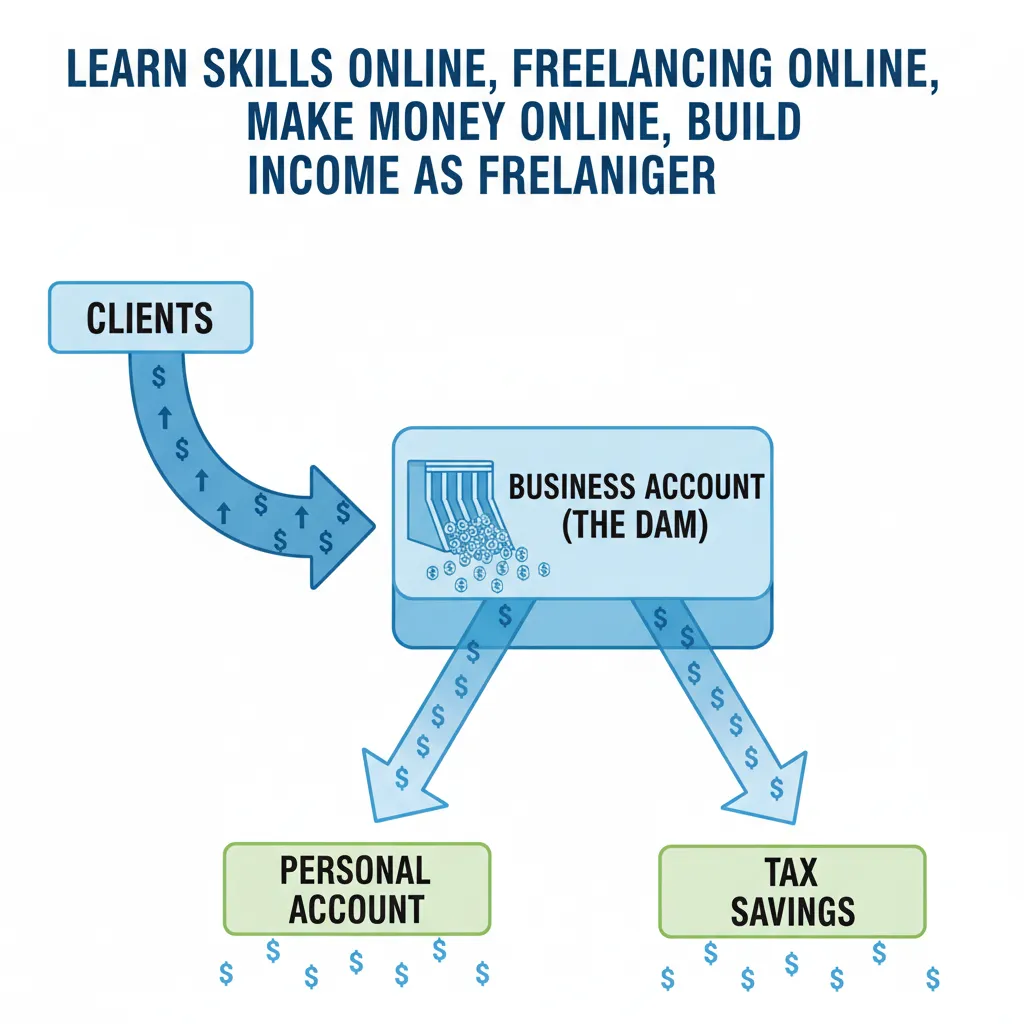

To build stability, you must decouple your client payments from your personal checking account. This is the “Income Smoothing” method.

1. The Buffer Account Strategy

You need a business checking account that acts as a dam. All revenue hits this account first. Before you pay yourself a dime, you need to build a “buffer” equivalent to 1-2 months of your personal living expenses inside this business account.

Why? Because according to the YunoJuno Rates Report 2025, the average project length is 23 working days. There are natural gaps between these projects. The buffer fills those gaps.

2. The Salary Math

Once your buffer is established, set up an automatic transfer from your business account to your personal account. This transfer should happen on the same day every month (or bi-weekly), for the exact same amount, regardless of how much you earned that month.

- Good Month ($10k revenue): You transfer your fixed $4k salary. The remaining $6k builds your buffer.

- Bad Month ($2k revenue): You transfer your fixed $4k salary. The buffer covers the deficit.

This psychological shift is massive. It allows you to budget for a mortgage, plan vacations, and sleep at night.

Interactive Tool: The Freelance Rate Calculator

To make income smoothing work, you need to know what to charge. Most people forget to factor in the “unbillable” hours—time spent pitching, invoicing, and marketing. Use this calculator to determine the daily rate you actually need to hit your salary goals.

Freelance Rate Calculator (Post-Tax & Expenses)

Required Daily Rate:

*This includes your tax buffer and overhead.

Tiered Client Strategy: Building a Recession-Proof Portfolio

Stability doesn't come from having one big client. That’s just a job with no benefits and zero severance pay. To be truly secure, you need a diversified portfolio. I call this the "3-Tier Client Structure."

Tier 1: The Anchor Client (40-50% of Income)

This is your foundation. An anchor client is on a retainer or a long-term contract (6-12 months). The rate might be slightly lower than your "premium" project rate, but the volume and consistency are guaranteed.

According to Staffing Industry Analysts (Sept 2025), 5.6 million U.S. freelancers earned over $100,000 in 2024. A common thread among them? They don't hunt for work every month. They have anchors.

Tier 2: The Growth Projects (30-40% of Income)

These are high-fee, one-off projects. This is where you make your profit margin. Because your Anchor client covers your basic bills, you can afford to be picky here. You can charge "Value-Based" prices.

If a client balks at your high rate, you can walk away because your Anchor has your back. This negotiation leverage is how you raise your rates over time.

Tier 3: Passive/Semi-Active Income (10-20% of Income)

This is the safety net. This could be digital products, a paid newsletter, or affiliate income. It’s money that comes in whether you work that day or not.

Case Study: The Power of Specialization

Take Anna Burgess Yang. By 2025, she scaled her fintech writing business to $0.95/word. How? She didn't just "write." She specialized in a technical niche (fintech) that AI hadn't disrupted and built a referral network that provided 83% of her new business. She moved from Tier 2 projects to Tier 1 relationships.

Financial Infrastructure: Tools for the Modern Solopreneur

You cannot run a six-figure business using a personal PayPal account. In 2025, specialized fintech tools are essential for handling taxes and cash flow.

Best Business Banking for 2025

When selecting a bank, look for "Tax Automation" features. You want a bank that automatically sets aside a percentage of every deposit into a sub-account for the IRS.

- Lili: Excellent for integrated tax planning and expense categorization.

- Novo: great for integrations with tools like Slack and Stripe.

- Mercury: The gold standard for startups and scaling agencies.

Accessing Capital

Sometimes, clients pay late. It happens. You need access to capital to bridge the gap without using predatory credit cards. Services like PayPal Working Capital and Square Loans assess your lending eligibility based on your sales history, not just your credit score.

Warning: Always read the terms. As detailed in the MBO Partners reports, financial independence requires managing debt responsibly.

Scaling to Six Figures: Upskilling and Value-Based Pricing

To break the income ceiling, you must decouple your time from your money. Working by the hour limits your income to the number of hours you can stay awake.

49% of freelancers expected to raise their rates in late 2024, according to the Fiverr Economic Impact Report (May 2024). If you aren't raising yours, you are effectively taking a pay cut due to inflation.

Transition to Outcome-Based Pricing. Don't charge for the 5 hours it takes to build a landing page; charge for the $10,000 in sales that landing page will generate for the client. This shift is how you move from a $50k earner to a $150k earner.

of full-time independents report being happier working for themselves than in traditional jobs, despite the risks.

Source: MBO Partners, 2024

Frequently Asked Questions

Conclusion: Your 90-Day Roadmap

Building a steady freelance income isn't about finding a "magic" client. It's about building a system that can withstand the chaos of the market. You are no longer just a freelancer; you are the CEO of a service business.

Here is your immediate action plan:

- Week 1: Open a separate business bank account (Lili/Novo/Mercury).

- Week 2: calculate your "Minimum Viable Rate" using the tool above and audit your current clients.

- Month 1: Secure one "Anchor Client" on a retainer agreement to cover at least 50% of your base expenses.

- Month 3: Build your 1-month financial buffer.

The global workforce is changing. With 1.57 billion people freelancing worldwide (World Bank via DemandSage, Nov 2025), the opportunity has never been greater. The only question is: Will you treat this like a gig, or will you build it like a business?