12 Simple Ways to Increase Your Monthly Income in 2025 (Expert-Verified)

Look, I know the feeling. You open your banking app, stare at the balance, and calculate exactly how many days are left until payday. It’s a universal stress test right now.

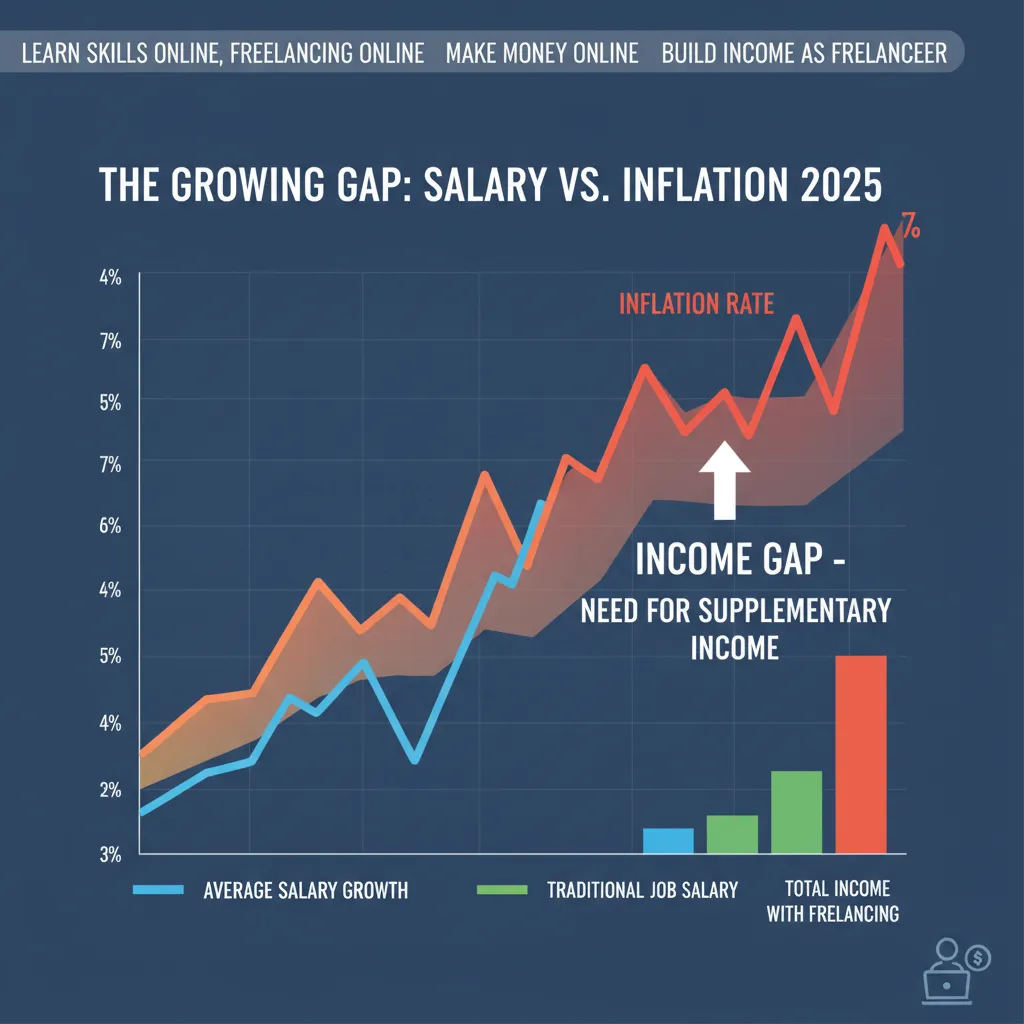

With inflation recalibrating the cost of virtually everything, sticking to a 2024 budget in 2025 feels like trying to fit a square peg in a round hole. In fact, to maintain the same standard of living you enjoyed last year, reliable economic indicators suggest you need significantly more cash flow.

According to U.S. Bureau of Labor Statistics data from November 2025, 8.9 million Americans are now working multiple jobs—a 5.4% rate that we haven’t seen since the Great Recession. You aren’t alone in looking for a financial buffer.

But here is the good news: You don’t necessarily need a grueling second 9-to-5 to bridge the gap. In my years covering personal finance, I’ve seen the landscape shift from “driving for Uber” to more sophisticated, low-friction wealth generation.

This guide isn’t about generic advice. We are going to explore expert-verified, simple ways to increase your monthly income by $200 to $1,100, focusing on the specific economic opportunities of 2025.

The “Low-Effort” Advantage: Maximizing Your Current Assets

Before we talk about working more, let’s talk about making your existing assets work harder. This is the closest thing to “free money” you’ll find, yet so many people leave it on the table.

1. Move Cash to High-Yield Savings Accounts (HYSA)

If your emergency fund is sitting in a traditional checking account earning 0.01%, you are effectively losing money to inflation every single day. The interest rate environment of 2024–2025 has created a unique window for savers.

By simply transferring your savings to a High-Yield Savings Account (HYSA), you can generate passive monthly income without lifting a finger. It sounds too simple to be true, but the math doesn’t lie.

The Interest Rate Reality

4.5% – 5.25%

Current APY range for competitive HYSAs in early 2025.

According to Bankrate, while inflation is cooling, interest rates remain elevated, allowing savers to secure meaningful yields. If you have $10,000 in savings, a 5% APY accounts for $500 a year—or roughly $41 a month—just for clicking “transfer.”

2. Monetize Underutilized Equipment

The “sharing economy” has matured. You no longer need to let strangers sleep in your spare room to make money. Now, it’s about micro-rentals of assets you already own but rarely use.

Do you have a DSLR camera gathering dust? A power drill you use twice a year? A parking spot in a city center? Platforms like Fat Llama (for gear) or Neighbor (for storage) allow you to turn these liabilities into assets.

I recently spoke with a graphic designer who rents out her specialized lenses on weekends. She covers her entire monthly utility bill just by letting other creatives use gear she wasn’t using anyway. It’s low friction and high reward.

The “Knowledge Economy”: Freelancing & Skill Stacking

If you have specific skills, the freelance market in 2025 offers a different playing field than it did five years ago. The rise of AI hasn’t destroyed freelancing; it has evolved it.

3. AI-Assisted Freelancing

The biggest barrier to freelancing used to be time. Writing a blog post or coding a landing page took hours. In 2025, “AI Orchestration” is the new skill. Clients aren’t just looking for writers; they are looking for editors who can prompt Large Language Models (LLMs) to produce 80% of the work, then apply human expertise to the final 20%.

— According to Upwork Research Institute, April 2025

By leveraging tools like ChatGPT or Midjourney, you can triple your output. This allows you to take on more micro-contracts without burning out. The key is positioning yourself not as a “writer” or “designer,” but as an AI-powered specialist who delivers faster results.

4. Specialized Micro-Tutoring

With the rapid pace of technological change, the “skills gap” is widening. Professionals are desperate to learn specific skills quickly. We aren’t talking about semester-long courses; we’re talking about 30-minute Zoom calls to solve a specific problem.

If you know how to navigate advanced Excel macros, set up a specific CRM, or speak a second language, you can monetize that “micro-knowledge.”

According to a May 2025 report from the Upwork Research Institute, skilled freelancers generated $1.5 trillion in earnings in 2024, with a median full-time freelance income of $85,000—actually higher than the median for full-time employees. The demand for specialized knowledge is outpacing the demand for general labor.

The “Passive” Frontier: Digital Assets & Automation

Passive income is the holy grail, but let’s be honest: it usually requires upfront work. However, once built, these streams can provide that extra $500–$1,000 monthly cushion.

5. Selling Digital Templates

In my opinion, this is one of the most scalable ways to increase income in 2025. We are seeing a massive shift toward “done-for-you” digital products. Think Notion templates for project management, Canva templates for social media, or budgeting spreadsheets.

You create the asset once, and it sells indefinitely. Educators, for example, are seeing massive returns here. According to Meriwest Credit Union (July 2025), educators on platforms like Teachers Pay Teachers are reporting over $1,000/month through bundled lesson plan templates. This requires “medium upfront effort” but delivers high recurring monthly yields.

6. Automated Cash-Back & Reward Optimization

This isn’t about clipping coupons. It’s about sophisticated credit card stacking. By aligning your highest spending categories (groceries, gas, dining) with cards that offer 3–5% cash back, and using shopping portals like Rakuten, you can effectively give yourself a raise.

I treat this as a game. If your household spends $3,000 a month on necessities, a strategic 4% return is $120 tax-free dollars back in your pocket. It’s not a fortune, but it covers a utility bill.

Side Hustle Reality Check: The Data

Before you dive in, it is crucial to manage expectations. There is a difference between what influencers say you can make and what the data shows.

According to Bankrate (July 9, 2025), “Side hustlers earn an average of $885 per month, but the median is just $200 per month.”

Why the discrepancy? The “average” is skewed by high earners (the top 10% making thousands). The “median” represents the typical person. To break out of the median and hit that $885+ average, you need to treat your side hustle like a business, not a hobby.

A major factor in success is automation. According to Zapier/Millennial Money, 65% of side hustlers use automation to streamline their business, with 14% being fully automated. If you aren’t using tools to schedule your social media, invoice clients, or manage emails, you are working too hard for too little.

💰 Monthly Income Potential Calculator

Estimate your potential earnings based on 2025 market rates.

Corporate Growth: Asking for What You’re Worth

Sometimes the simplest way to increase your monthly income isn’t to get a *new* job, but to get paid properly for the one you have.

The 2025 Negotiation Strategy

The labor market remains resilient. According to Julie Su, Acting Secretary of Labor (Dec 2024), “The American economy added 256,000 jobs in December, reflecting a robust and resilient labor market with unemployment at 4.1%.”

This stability gives you leverage. If you haven’t received a raise that matches the Cost of Living Adjustment (COLA), you are technically taking a pay cut. When approaching your manager, bring data—not feelings.

- Document Productivity: Show exactly how you contributed to revenue or savings.

- Cite Inflation: Politely reference the CPI data to frame your request as a “correction” rather than a “raise.”

- Skill Stacking: Highlight new AI or technical skills you’ve acquired since your last review.

— Kelly Monahan, Managing Director at Upwork Research Institute, May 2025

This quote from Kelly Monahan highlights a shift in mindset. If your current employer won’t budge, the “freelance knowledge work” path is becoming a valid competitor to traditional employment, giving you the ultimate BATNA (Best Alternative to a Negotiated Agreement).

Frequently Asked Questions

How can I increase my monthly income by $500?

Based on the $200 median vs. $885 average split reported by Bankrate, hitting $500 requires moving beyond basic gig work. The most reliable path to $500 is “stacking”: combining $200 from HYSA interest/rewards with $300 from 5–6 hours of skilled freelancing (like editing or virtual assistance) per month.

What are the best low-effort ways to earn extra cash?

The absolute lowest effort methods involve asset monetization. Renting out storage space, parking spots, or moving savings to a High-Yield Savings Account requires almost zero active labor once set up. Selling digital templates is also low-effort *after* the initial creation phase.

What is the average monthly income from a side hustle in 2025?

As noted earlier, Bankrate data from July 2025 indicates the average is $885/month, while the median is $200/month. This huge gap suggests that consistency and skill level are the main differentiators between pocket money and a second income.

Conclusion: Building Your Financial Moat

Increasing your monthly income in 2025 isn’t about finding a magic bullet; it’s about diversification. The days of relying on a single paycheck are fading as the cost of living fluctuates. Whether you choose to leverage high interest rates, monetize a hobby, or use AI to freelance efficiently, the goal is the same: financial resilience.

Start small. Open that High-Yield Savings Account today. List that one unused item for rent. Pitch one freelance client. The difference between the median earner ($200) and the high earner ($1,000+) is usually just the willingness to start.

You have the data. You have the tools. Now, go get what you’re worth.