How to Turn Your Hobby into an Online Business: The Definitive 2025 Guide

You’re likely sitting on a goldmine, and you might not even realize it.

Whether it’s knitting bespoke scarves, consulting on digital marketing, or woodworking in your garage, the line between “pastime” and “profit center” has never been thinner. In fact, according to data from the U.S. Chamber of Commerce, the total number of new business applications for 2024 hit a staggering 5.2 million. Most of these weren’t Silicon Valley tech giants; they were born from kitchen tables, spare bedrooms, and home studios just like yours.

But here’s the thing: Passion alone doesn’t pay the mortgage. I’ve worked with hundreds of aspiring entrepreneurs who dive in headfirst, only to get crushed by tax audits, legal confusion, or simply building a product nobody wants.

In this guide, we aren’t just talking about “following your dreams.” We are going to build a compliance fortress around your idea. We will navigate the 2025 legal framework, including the pivotal changes to the Corporate Transparency Act (CTA), decode the IRS “Hobby Loss” rules, and look at the actual math of scaling a side hustle into a six-figure online business.

Let’s get to work.

Step 1: Market Validation (The “Demand” Test)

Before you file for an LLC or print business cards, you need to answer one uncomfortable question: Does anyone actually care?

The biggest mistake I see people make is falling in love with their product before falling in love with their customer’s problem. You might bake the best sourdough in your zip code, but is there a market willing to pay a premium for it online?

Analyzing Niche Saturation

In 2025, the creator economy is valued at $250 billion and is projected by Goldman Sachs to reach nearly half a trillion dollars by 2027. That is a massive pie, but it also means crowded tables.

To validate your idea without spending a dime:

- Google Trends Analysis: Look for consistent growth over 5 years. Avoid seasonal spikes (unless you want a seasonal business).

- The “Pain Point” Search: Go to Reddit or niche forums. Look for phrases like “I hate when…” or “Why is there no…” related to your hobby. That is where your business opportunity lives.

- Competitor Audit: If nobody is doing what you’re doing, that’s a red flag. It usually means there’s no market. You want to see competitors, but you need a “unique selling proposition” (USP) that differentiates you.

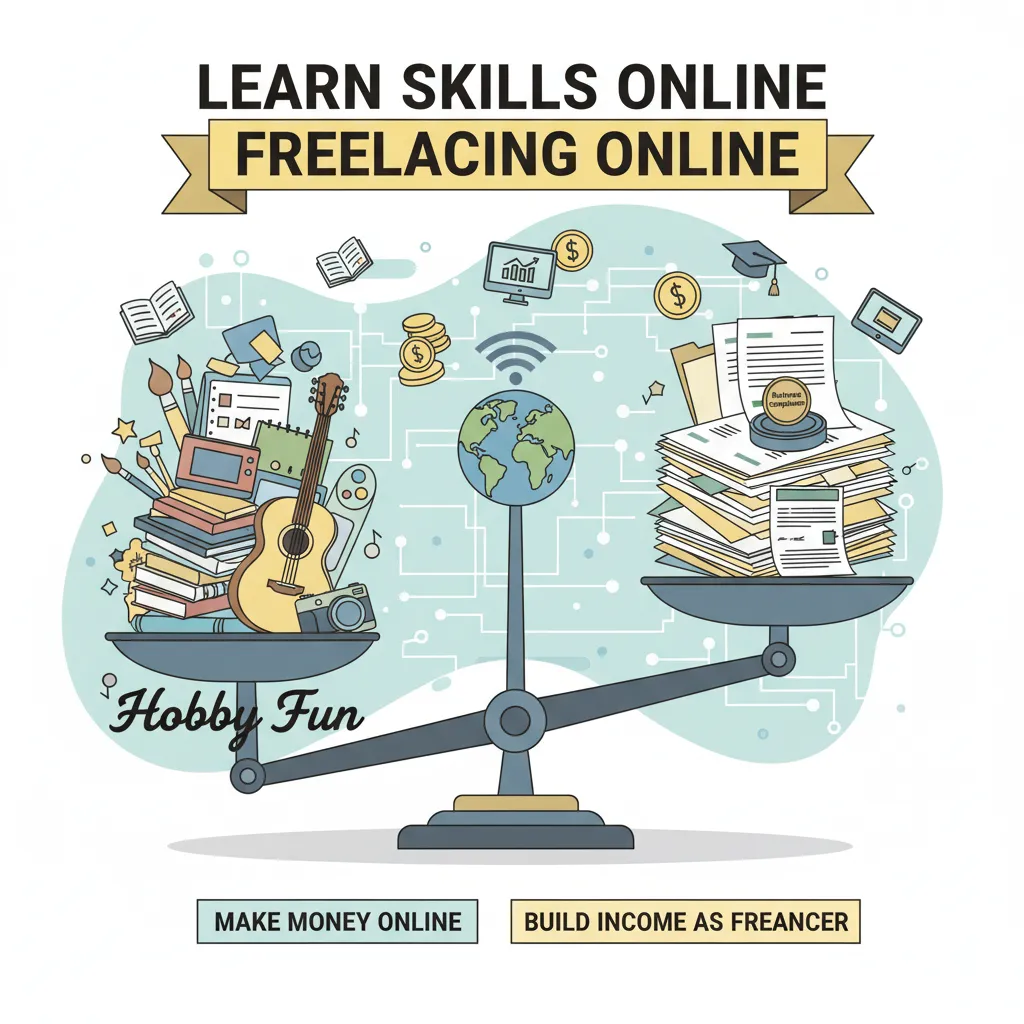

Step 2: Choosing Your 2025 Revenue Model

Turning a hobby into a business doesn’t always mean selling the physical thing you make. In the current passion economy, how you sell is just as important as what you sell.

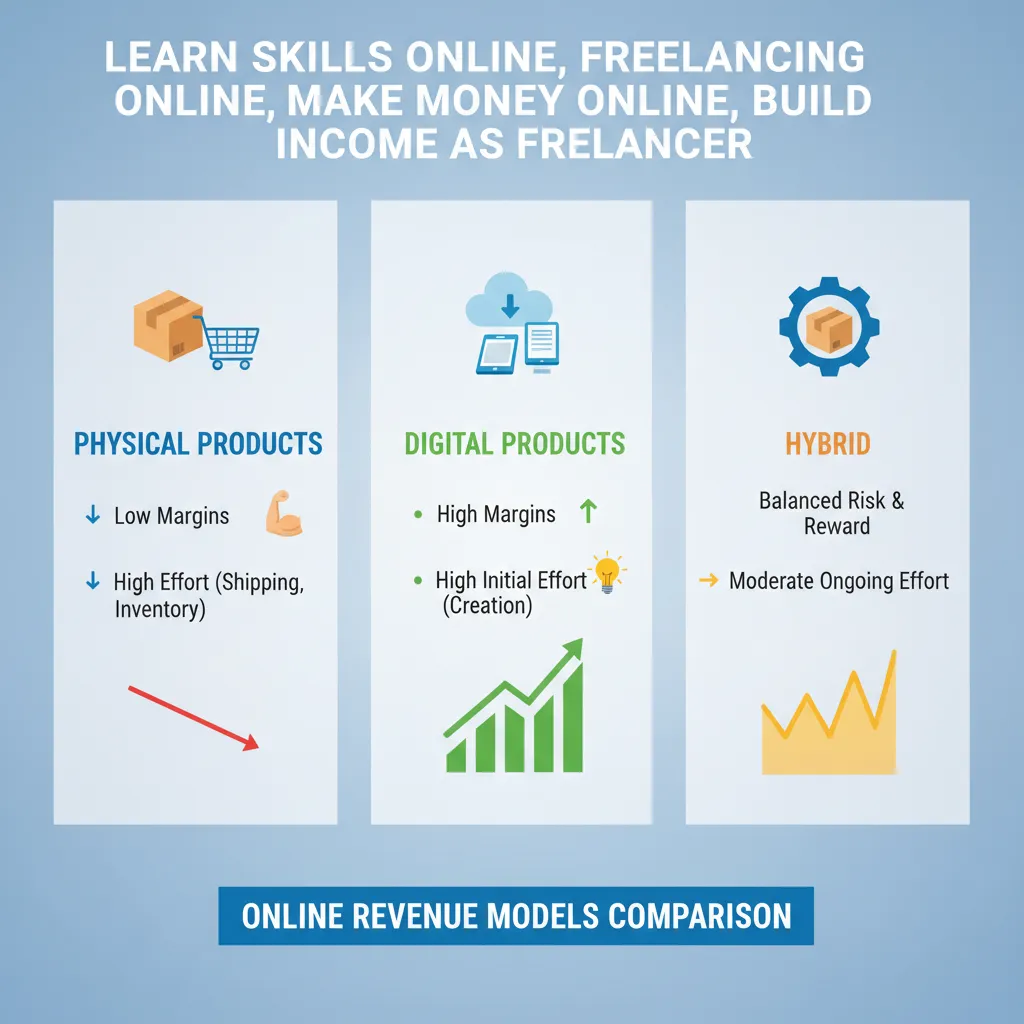

Physical Goods vs. Digital Expertise

If you are a woodworker, your instinct is to sell tables. But shipping tables is expensive and hard to scale. This is where the concept of Hybrid Monetization comes in.

Successful hobby-businesses in 2025 often combine models:

- The Maker Model: Selling the physical item (Etsy/Shopify).

- The Teacher Model: Selling the course on “How to Make the Item” (Teachable/Thinkific).

- The Curator Model: Selling the tools and supplies you use (Affiliate marketing/Dropshipping).

Step 3: Legal & Tax Architecture (The 2025 Update)

This is the section most “hobby to business” guides skip, and it’s exactly where new entrepreneurs get into trouble. The regulatory landscape changed dramatically in late 2024 and early 2025.

The Corporate Transparency Act (CTA): A 2025 Reversal

Throughout 2024, small business owners were panicked about the Corporate Transparency Act, which required registering “Beneficial Ownership Information” (BOI) with FinCEN. It came with steep fines for non-compliance.

However, legal challenges have shifted the landscape. As noted by the NFIB in April 2025, recent court rulings have been a “major victory,” meaning many small U.S. businesses may now be exempt from these onerous reporting requirements. However, you must check with a registered agent in your state, as this situation is fluid. Never assume you are exempt without verifying.

IRS Section 183: The “Hobby Loss” Rule

When does the IRS consider your side hustle a business? It’s not when you print business cards; it’s when you show a profit. Under IRS Section 183, if your activity is not carried on for profit, allowable deductions are limited.

The “Safe Harbor” rule generally states that the IRS presumes an activity is a business if it makes a profit in at least 3 of the last 5 tax years. If you fail this test, the IRS may retroactively classify your business as a hobby and disallow your business deductions.

| Factor | Hobby Characteristics | Business Characteristics |

|---|---|---|

| Record Keeping | Informal or non-existent. | Accurate, separate books and bank accounts. |

| Time & Effort | Sporadic, done only when convenient. | Regularity and continuity; intent to make profit. |

| Dependence on Income | You don’t rely on this money for livelihood. | Losses hurt your financial stability. |

| Profit History | Consistent losses with no change in strategy. | Profits in 3/5 years, or clear strategy to improve. |

The 2025 Tax Environment

There is good news. The One Big Beautiful Bill Act (OBBBA) updates for 2025 have solidified the 20% Qualified Business Income (QBI) deduction for pass-through entities (like LLCs and Sole Proprietorships). This is essentially a 20% tax break on your bottom line.

Furthermore, if you are driving to post offices or supply stores, track every mile. According to IRS.gov, the standard mileage rate for business use in 2025 is 70 cents per mile. That adds up fast.

Interactive Profit Margin Calculator

Is your hobby actually profitable? Or are you just paying for an expensive pastime? In 2025, the average recommended profit margin for a small online business ranges between 10% and 50%, according to the Toast Tab 2025 Report. Use the tool below to check yours.

2025 Profit Margin Estimator

Step 4: Building a “Minimum Viable Brand” (MVB)

You do not need a $5,000 branding package. In the early stages, you need an MVB. This consists of a consistent color palette, a legible logo, and a clear tone of voice.

The goal is trust, not perfection. When someone lands on your site, do they feel safe entering their credit card information? Tools like Canva or Hatchful can get you 90% of the way there for free.

Step 5: Customer Acquisition in the Privacy-First Era

Gone are the days when you could throw $50 at Facebook Ads and get instant sales. With privacy changes in iOS and cookie depreciation, the “Spray and Pray” method is dead.

In 2025, success comes from Organic Community Building. This means:

- Short-form Video: Showing the “behind the scenes” of your hobby (TikTok/Reels). People buy the process as much as the product.

- Email Marketing: You must own your audience. Social media algorithms change; your email list is an asset you own forever.

- Partnerships: Collaborating with other hobbyists in adjacent niches.

Case Study: From Hobby to $28k/Month

Consider the story of Sarah Chen, owner of Sweet Delights Bakery. She started baking as a weekend stress-relief hobby in 2020. She didn’t jump straight into a storefront. Instead, she mastered local SEO and Instagram Reels showcasing her decorating process.

By March 2025, according to Upskillist Success Stories, she scaled to a $28,000/month revenue stream. Her secret? She diversified. She sells custom cakes locally (physical), but also sells “Cookie Decorating Kits” nationwide (hybrid) and a PDF guide on “Starting a Home Bakery” (digital).

Step 6: Real-World Success & Automation

Once you have sales, the hobby stops being fun if you are up until 2 AM packing boxes. This is where automation kicks in.

Take Emily Martinez, an Etsy Artisan. In a case study by SuperAGI (2025), Emily faced burnout. By implementing AI-driven marketing automation to handle her email flows, she achieved a 32% decrease in cart abandonment. She didn’t work harder; she let the software nudge customers who were on the fence.

Conclusion: The Leap of Faith

Turning your hobby into an online business is one of the most rewarding challenges you can undertake. It forces you to grow, not just as a creator, but as a strategist.

Remember the core pillars we discussed:

- Validate first: Don’t sell what people aren’t searching for.

- Protect yourself: Separate your finances and understand IRS Section 183.

- Diversify revenue: Don’t just sell the item; sell the knowledge.

- Focus on margin: Use the calculator above. If the math doesn’t work, it’s just a hobby—and that’s okay, too.

The tools, the market size, and the technology are all there in 2025. The only variable left in the equation is you. Start small, stay compliant, and build something that lasts.